Tax deductions for home office renovations in the United States are an area of interest for many taxpayers who work from home. The Internal Revenue Service (IRS) provides specific guidelines that determine whether a taxpayer can claim these renovations as a deduction.

.

To be eligible, the space must be used regularly and exclusively for business, and the deduction can only apply to the portion of your home used for business.

.

I found this page by the IRS really helpful. Take a look.

When considering strategic renovations for tax benefits, taxpayers must navigate the IRS rules carefully.

.

Renovations that are directly related to the home office and do not extend to other parts of the home are more likely to be deductible.

.

These may include repairs or improvements to maintain a home office, such as painting, installing shelves, or upgrading internet hardware crucial for business operations.

.

Taxpayers often encounter common mistakes when claiming home office renovation deductions. Overstating expenses, renovating areas not used for the home office, or incorrectly calculating the proportion of the home used for business can lead to complications with the IRS.

.

Thus, it’s crucial for individuals to carefully document their expenses and seek advice if they are uncertain about the eligible deductions related to home office renovations.

Determining Eligibility for Home Office Deductions

When seeking to reduce one’s taxable income through home office expenses, it’s critical that taxpayers comply with specific IRS guidelines to qualify for deductions.

IRS Requirements for Home Office Deductions

There are stringent conditions set by the Internal Revenue Service (IRS) for home office deductions. A taxpayer must use a portion of their home exclusively and regularly for business activities. The following are key aspects of the requirements:

- Exclusive Use: The area designated as the office must be used solely for business purposes. It cannot be a multipurpose space that is also used for personal activities.

- Regular Use: The home office must be used consistently for business. Occasional or incidental use does not qualify.

- Principal Place of Business: The space must be the taxpayer’s primary place for conducting business, although it does not have to be the only location.

- Separate Structure: A separate unattached structure on the property, like a studio or garage, can also qualify if it meets the exclusive and regular use criteria.

.

To claim a deduction for home office expenses, the taxpayer must itemise and report these expenses on Form 8829. Strategic renovations that are directly related to the home office, such as built-in furniture or improved lighting, can be deductible if they meet the above criteria.

.

Taxpayers often make mistakes by not maintaining clear records or by misinterpreting the usage requirements. Keeping detailed records of expenses and use is essential to substantiate deductions and avoid common pitfalls.

.

Claiming expenses for unrelated home upgrades, such as remodelling a kitchen or bathroom not used for business, will typically not qualify for home office deductions.

Calculating Your Home Office Deduction

When determining the home office deduction, taxpayers must consider the types of expenses and the calculation method employed. Making strategic choices can optimise their tax benefits.

Direct vs. Indirect Expenses

Direct Expenses are fully deductible and apply solely to the home office. Examples include painting or repairs confined to the home office.

- Fully Deductible

- Painting the office

- Office-only repairs

Indirect Expenses benefit the entire home and are deductible based on the percentage of the home used for business.

- Proportionately Deductible

- Mortgage interest

- Insurance

- Utilities

Taxpayers should aim to accurately differentiate these expenditures to maximise tax breaks while complying with IRS rules.

Simplified Option vs. Regular Method

The Simplified Option grants a standard deduction of $5 per square foot of home used for business, up to 300 square feet.

- Benefits:

- Easier calculation

- Less paperwork

The Regular Method involves detailed tracking of actual expenses and allocating a percentage based on the home office’s square footage.

- Calculation steps:

- Determine total home square footage.

- Calculate office space percentage.

- Allocate expenses accordingly.

While the Simplified Option offers ease, the Regular Method can lead to larger deductions if substantial indirect expenses are present.

.

Renovations planned with tax benefits in mind should be evaluated for deduction eligibility under each method.

.

Taxpayers must maintain records to substantiate claimed deductions, being aware of common mistakes to avoid such as overestimating home office space or claiming ineligible expenses.

Record Keeping and Documentation

Effective record-keeping and documentation are critical when claiming home office renovations as tax deductions in the United States. Taxpayers should be meticulous in maintaining records that substantiate the necessity of the renovations for business purposes, in accordance with IRS regulations.

What Records to Keep:

Taxpayers should retain:

- Invoices and Receipts: All original invoices and receipts for home office renovation expenses.

- Bank Statements: Statements showing payment for these expenses.

- Photographic Evidence: Before and after photos of the home office to demonstrate the improvements made.

- Floor Plans: Diagrams indicating the portion of the home used exclusively for business.

- Purpose of Renovations: A written explanation of how the renovations directly relate to the taxpayer’s business activities.

Reuse of space for business and personal needs can disqualify expenses. It is essential for taxpayers to establish the exclusivity of their home office use.

How to Organise Documentation:

To organise records effectively, taxpayers should:

- Digital Storage: Scan and store digital copies of all documents, categorised by tax year.

- Physical Filing: Retain well-organised physical copies, especially for documents that require original signatures.

- Labeling: Clearly label folders with the type of document and the corresponding tax year.

- Timeline: Keep records for at least three years from the date of filing the tax return, as required by the IRS.

Maintaining meticulous records is necessary to substantiate claims and defend against common pitfalls, such as claiming renovations for non-exclusive use areas. Renovations must be strategic, directly benefiting the business to ensure compliance with IRS rules on home office upgrades.

Avoiding Common Pitfalls

When considering home office renovations for tax deductibility, it is crucial to navigate the intricacies of tax rules to ensure compliance and avoid triggering audits.

Red Flags for Audits

One must understand that the IRS maintains clear regulations regarding home office expenses. Taxpayers should maintain a dedicated area used primarily for businesses to claim a deduction.

.

Strategic renovations may enhance the legitimacy of claims, but erratic and excessive deductions can raise red flags.

.

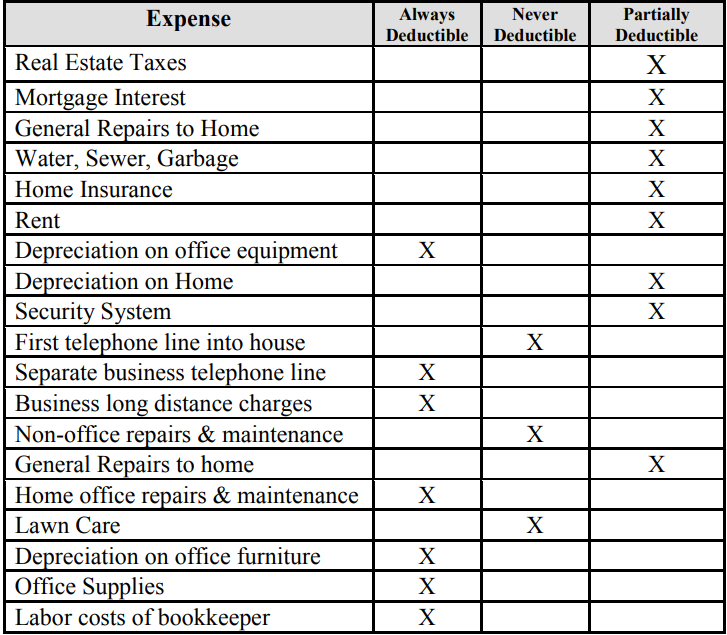

To claim a deduction for home office expenses, these must relate directly to earning income. Taxpayers are allowed to claim a percentage of home office expenses such as phone bills, depreciation on office furniture and equipment, and utilities.

.

However, the cost of renovations could be claimed over several years as a capital works deduction.

.

The IRS specifies that renovations must be directly connected to the taxpayer’s income-producing work.

.

For example, improving the acoustics of a home office for a professional podcaster may be considered a legitimate expense. In contrast, upgrades not directly related to business tasks, like adding an unrelated landscaping feature, would not be eligible.

.

Auditors look closely at deductions that seem disproportionate to the income reported. A substantial upgrade to a home office might trigger scrutiny if the claimed deductions are not commensurate with the taxpayer’s earnings.

.

Taxpayers should keep meticulous records of both income and expenses, as well as photographs of the home office space, before and after any improvements.

.

Documentation is key to substantiating claims and providing clear evidence in case of an audit.

.

Common mistakes include claiming personal living expenses as business deductions and not keeping clear boundaries between home and business use. For instance, one should not claim the entire electricity bill if only a small portion of the home is used as an office.

.

Moreover, it’s advisable for taxpayers to consult the IRS guidelines or a tax professional before undertaking significant home office renovations aimed at tax deductions.

.

Staying on top of changes in tax legislation can also prevent falling afoul of the rules.

.

The IRS applies strict criteria for home office deductions, and it’s beneficial to be cautious and well-informed when planning and claiming such renovations.

.

This is a table available on the IRS website:

.

Frequently Asked Questions

Understanding the intricacies of tax deductions for home office renovations is essential for both remote employees and business owners. Key aspects include adherence to IRS regulations and strategic planning of renovations to maximise potential tax benefits.

Can renovations to a home office qualify for tax deductions for remote employees?

Renovations to a home office can indeed be tax deductible for remote employees if they are for a designated space used regularly and exclusively for work. They must also be necessary for the employee’s work.

What criteria must be met for home office improvements to be eligible for tax reductions with the IRS?

To qualify for a tax reduction, home office improvements must satisfy IRS criteria. The space must be the taxpayer’s principal place of business and used regularly and exclusively for work. Improvements should be necessary and directly related to the business.

Which home enhancements can be claimed as deductions for a property sold?

For a property sold, capital improvements that add value to the home, prolong its useful life, or adapt it to new uses may be claimed. These reduce the capital gains tax by increasing the cost basis of the home.

When operating a business from home, what types of property upgrades can be expensed?

Business owners operating from home may expense both direct and indirect improvements. Direct expenses are fully deductible and relate solely to the home office. Indirect expenses benefit the entire home and are deductible based on the percentage of the home used for business.

For rental properties, are investments in home improvements deductible from your taxes?

Investments in home improvements for rental properties can be deductible. They are treated as capital expenditures and can be depreciated over the property’s useful life, not claimed entirely in the year the expense was incurred.

Is furniture purchased for a home office, such as desks, eligible for tax write-offs?

Furniture acquired for a home office, like desks and chairs, can be eligible for tax deductions. These items are considered depreciable assets and can be claimed based on their use for business purposes.